A correlation matrix of dimension n where all the off-diagonal elements have value r has an inverse matrix whose diagonal elements equal

(1 + (n-2)*r) / ((1-r) * (1 + (n-1)*r))

and off-diagonal elements equal

r / ((r-1) * (1 + (n-1)*r))

Given the expected returns mu and covariances cov of assets, when taking positions w the expected portfolio return is mu' * w, the variance is w' * cov * w, and optimal portfolio weights are proportional to cov^(-1) * mu. The program below specifies expected returns for 3 assets and studies how the optimal portfolio weights depend on the average correlation.

module kind_mod

implicit none

private

public :: dp

integer, parameter :: dp = selected_real_kind(15, 307)

end module kind_mod

module linear_solve

use kind_mod, only: dp

implicit none

public :: equicorr, inverse_equicorr_off_diag, inverse_equicorr

contains

pure function equicorr(n, r) result(xmat)

! return a correlation matrix with equal off-diagonal elements

integer , intent(in) :: n ! dimension of correlation matrix

real(kind=dp), intent(in) :: r ! off-diagonal correlation

real(kind=dp), allocatable :: xmat(:,:)

integer :: i

allocate (xmat(n, n), source = r)

do i=1,n

xmat(i,i) = 1.0_dp

end do

end function equicorr

pure function inverse_equicorr_off_diag(n, r) result(y)

! value of off-diagonal elements of the inverse of an equicorrelation matrix

integer , intent(in) :: n

real(kind=dp), intent(in) :: r

real(kind=dp) :: y

y = r / ((r-1) * (1 + (n-1)*r))

end function inverse_equicorr_off_diag

pure function inverse_equicorr_diag(n, r) result(y)

! value of diagonal elements of the inverse of an equicorrelation matrix

integer , intent(in) :: n

real(kind=dp), intent(in) :: r

real(kind=dp) :: y

y = (1 + (n-2)*r) / ((1-r) * (1 + (n-1)*r))

end function inverse_equicorr_diag

pure function inverse_equicorr(n, r) result(xmat)

! return the inverse of a correlation matrix with equal off-diagonal elements

integer , intent(in) :: n ! dimension of correlation matrix

real(kind=dp), intent(in) :: r ! off-diagonal correlation

real(kind=dp), allocatable :: xmat(:,:)

integer :: i

real(kind=dp) :: ydiag

ydiag = inverse_equicorr_diag(n, r)

allocate (xmat(n, n), source = inverse_equicorr_off_diag(n, r))

do i=1,n

xmat(i,i) = ydiag

end do

end function inverse_equicorr

end module linear_solve

program xequicorr_port

! find optimal portfolio as a function of correlation, given expected

! returns and assuming all volatilities (standard deviations) are 1,

! so that the covariance matrix equals the correlation matrix

use kind_mod , only: dp

use linear_solve, only: equicorr, inverse_equicorr

implicit none

integer :: ir

integer, parameter :: n = 3, nr = 10

real(kind=dp) :: r, xmat(n,n), xinv(n,n), mu(n), w(n), expected_ret, &

sd_ret

mu = 1.0_dp

mu(1) = 2.0_dp ! stock 1 has higher expected return

print "('expected asset returns:',*(f12.3))", mu

print "(/,*(a12))", "corr", "w1", "w2", "w3", "mean_ret", "sd_ret", "mean/sd"

do ir=1,nr

r = (ir-1) * 0.1_dp

xmat = equicorr(n, r)

xinv = inverse_equicorr(n, r)

w = matmul(xinv, mu)

w = w / sum(abs(w))

expected_ret = sum(w*mu)

sd_ret = sqrt(sum(w * matmul(xmat,w)))

print "(*(f12.3))", r, w, expected_ret, sd_ret, expected_ret/sd_ret

end do

end program xequicorr_port

Output:

expected asset returns: 2.000 1.000 1.000

corr w1 w2 w3 mean_ret sd_ret mean/sd

0.000 0.500 0.250 0.250 1.500 0.612 2.449

0.100 0.556 0.222 0.222 1.556 0.683 2.277

0.200 0.625 0.187 0.187 1.625 0.754 2.155

0.300 0.714 0.143 0.143 1.714 0.828 2.070

0.400 0.833 0.083 0.083 1.833 0.908 2.018

0.500 1.000 0.000 0.000 2.000 1.000 2.000

0.600 0.833 -0.083 -0.083 1.500 0.742 2.023

0.700 0.714 -0.143 -0.143 1.143 0.542 2.108

0.800 0.625 -0.188 -0.188 0.875 0.377 2.320

0.900 0.556 -0.222 -0.222 0.667 0.228 2.928

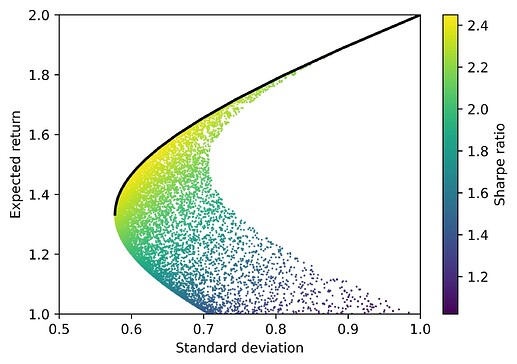

For the case of uncorrelated assets, twice as much weight is given to asset 1 than the other 2 assets, since its expected return is twice as high. As correlation increases, the weights given to assets 2 and 3 decrease, since they have lower returns and are less effective at diversifying asset 1. For correlation of 0.5 asset 1 gets weight 1.0 and the other assets weight 0.0. As correlation increases still further, the optimal portfolio goes long asset 1 but now bets against assets 2 and 3 (shorts them), since doing so hedges the position in asset 1 and reduces risk. One see that this boosts the Sharpe ratio (the last column, labeled mean/sd). What hedge funds are supposed to do is go long and short assets to maximize the Sharpe ratio.

An individual investor may be unable or unwilling to take short positions and may impose a long-only constraint. This results in a quadratic programming problem that can be solved by the quadprog package of @loiseaujc. The code above is also at my repo Matrix_Inversion.